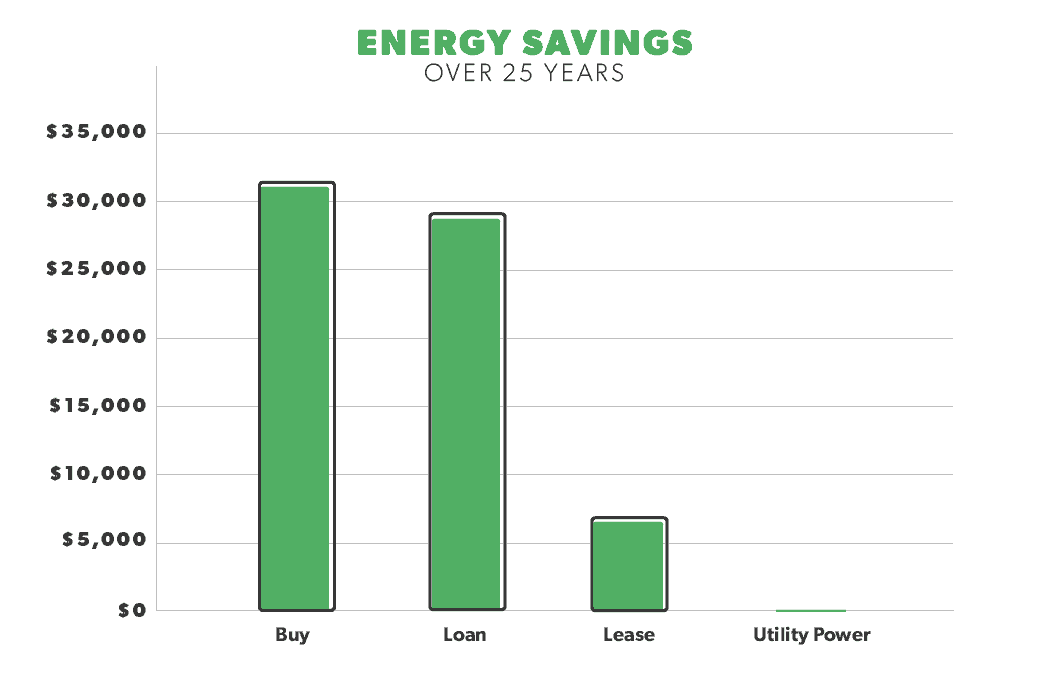

If you choose to get solar through a solar PPA or a solar lease. Solar tax credit amounts Installing renewable energy equipment in your home can qualify you for a credit of up to 30 of your total cost.

Leasing Solar Panels Is It Worth It Unbound Solar

Leasing Solar Panels Is It Worth It Unbound Solar

Another way to maximize the financial benefits of solar while minimizing its costs is to claim a federal investment tax credit ITC.

Can i get tax credit for leasing solar panels. The person who owns the system claims the credit so if you lease from a company they get to claim the credit not you. There are no California state income-tax credits for solar. Effects on Tax Credit People who dont want to pay the full price of their solar panel systems upfront but still want to receive the tax credit can get a solar loan.

The tax credit applies to the cost of equipment plus installation. According to HomeAdvisor the average cost to install solar panels on your roof is 21429So with such a high cost is there a possibility to get a tax deduction for a solar loan. It doesnt apply to solar leasing agreements.

No there will not be tax credits for you as the system is now used. How Much Money Can Be Saved with this Tax Credit. If say your federal taxes are 6000 for 2020 and youre eligible for a 7000 tax credit for installing a solar system at your house you.

You must also be the owner of the solar panel system in order to qualify for the solar tax credit. Can you claim the solar tax credit if you install solar panels yourself. This is also true for the vast majority of state and local incentives for solar although in some special cases a lease will grant you the financial benefits associated with the sale of solar renewable energy certificates SRECs.

OutBack FP1 w CS6P-250P httpbitly1Sg5VNH. This can reduce your cost for solar panels. Installing solar panels can help you save money on energy costs for years to come but the initial expense can be overwhelming.

23 2021 500 am. Anyone spending 10000 on a solar system would be able to claim back 3000 in credits. Yes DIY solar installations are eligible for the federal investment tax credit but only costs for equipment paid labor permitting and administration are eligible.

Yes as long as you purchase instead of lease your solar panel system. This applies to paying contractors and the cost of the parts. You can get the SRECs though.

With a solar loan homeowners are able to claim the solar investment tax credit without the hefty upfront cost of owning a solar power system. Do you get a tax credit for installing solar panels. Keep in mind that you can also finance your solar panels through a solar loan.

A solar loan will still give you the home. Of course you must be able to claim this tax credit which depends on your tax liability. Fortunately the federal government offers some help giving you a 30 tax credit.

Anyone who pays for a solar panel installation on their home or business they own can claim the solar tax credit as long as they have tax liability in the year of installation. If you sign a lease agreement the third-party owner gets the solar tax credit associated with the system. The tax credit is only on new equipment.

All tax credits are further divided into two types. The percentage you can claim depends on when you installed the equipment. Can I deduct any of the costs for leased solar panels.

The federal solar tax credit is a 26 tax credit that can be applied to your federal taxes during the year you have solar panels installed on your home. However community solar programs can be structured in various ways and even if you are eligible for the tax credit it may. Getty Images If youre thinking about installing.

You get a check f or a refundable tax credit even if you have no tax at all that year. Get all the details on the US governments tax credit for residential solar panels. Claiming the Solar Investment Tax Credit is worth 30 of the system cost.

Tax Credits13 that off-site solar panels or solar panels that are not directly on the taxpayers home could still qualify for the residential federal solar tax credit under some circumstances. But since the installation of solar power equipment can be costly the solar tax credit can help you offset some of the costs. The rent for the solar panels is not deductible on a federal tax return when installed on your personal residence.

The catch is that you must own the system.