It has an annual dividend yield of 052 per share and a. Equities market has realized significant gains in 2018 international markets and.

Rethinking The 50 50 Portfolio Seeking Alpha

Rethinking The 50 50 Portfolio Seeking Alpha

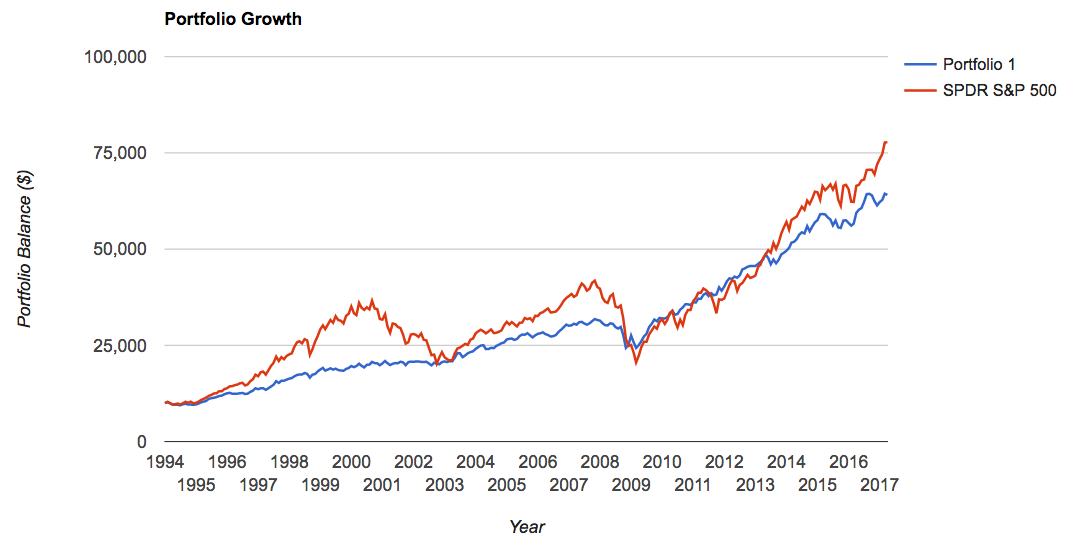

The SP 500 Why is my portfolio underperforming the market This question may be on your mind.

S&p 500 portfolio. However I think it is possible for investors to have a diversified portfolio that has a lot less volatility with a similar or even better return. The base ingredient in this portfolio is the SP 500 which is a good investment by itself. Koshinski Asset Management Inc.

The values of name companies. Both index mutual funds and exchange-traded funds ETFs maintain a. The short answer is that while the US.

Portfolio diversification encompasses buying mid- and small-cap companies along with large-caps. Companies and captures approximately 80 coverage of available US. SPDR SP 500 ETF Trust SPY.

The institutional investor bought 6392 shares of the companys stock valued at approximately 242000. Several other institutional investors and hedge funds have also recently modified their holdings of the stock. In this context the SP 500 is a common benchmark against which portfolio performance can be evaluated.

Allocating funds to international companies. Equity by market cap. Lifted its stake in SPDR Portfolio SP 500 Value ETF NYSEARCASPYV by 10514 in the first quarter according to the company in.

Launched in 2000 the SPDR Portfolio SP 500 Growth ETF has an expense ratio of 004 and a PE ratio of 3133. 47 rows Get a complete List of all SP 500 stocks. The Standard Poors 500 Index or simply SP 500 is a market-capitalization-weighted index of 500 large-cap US.

A lot of investors have a 100 SP 500 portfolio especially in the United States. It is a question that investors sometimes ask after stocks shatter records or return exceptionally well in a quarter. Bought a new position in SPDR Portfolio SP 500 Value ETF NYSEARCASPYV during the 1st quarter Holdings Channel reports.

Interestingly of the stocks I own only Procter Gamble was found in the top 30 stocks of the SP 500 though almost all the other stocks in my sub-portfolio are found in the SP 500 further. The lowest cost SP 500 Index funds have an expense ratio of less than 01 percent which means an investor would pay 1 or less in fees for. An SP 500 Index fund can help your portfolio gain broad exposure to those kinds of stocks with minimal due diligence.

The SP 500 index on which these funds are based has returned an average of about 10. 1 It is widely regarded. A straightforward low-cost fund with no investment minimum The Fund can serve as part of the core of a diversified portfolio Simple access to 500 leading US.

Dow Jones Industrial Average SP 500 Nasdaq and Morningstar Index Market Barometer quotes are real-time. The SP 500 consists of only large-cap US. 2 rows The Invesco Equally-Weighted SP 500 Portfolio seeks total return through growth of capital and.

The SP 500 index is weighted by market capitalization share price. Investing Learn Start Investing Investing Classroom. Over the long-term a simple portfolio like the one mentioned above performed greatly over the past 50 years.

Companies that make up 80 of US. Market capitalization Invests in. Learn more about SPY ARCX investment portfolio including asset allocation stock style sector exposure financials sustainability rating and holdings.

Standard Poors 500 index funds are among todays most popular investments - and its little wonder why. For the past 51 calendar years from 1970 through 2020 the SP 500. Investment Partners LTD.