The tax on 12000 in sales would be approximately 960 and you may have an additional 50 or so in fines and penalties which bring your risk into the 1500 range We cant stress this enough deciding when to get started with sales tax is the responsibility of the business owner. Additionally effective July 1 2021 marketplace providers are required to register to collect and electronically remit sales and use tax on taxable sales.

The Seller S Guide To Ecommerce Sales Tax

The Seller S Guide To Ecommerce Sales Tax

If you are selling goods over the Internet and your company has a presence in the state of delivery your company has established nexus and will be required to register to collect sales tax on all taxable items regardless of method of order placement.

Sales tax for online sales. This equates to 3000 a year or 12000 over a 4-year period. On June 21 2018 the US. While several states implemented the tax it was delayed in Florida as both Republicans and Democrats argued against it.

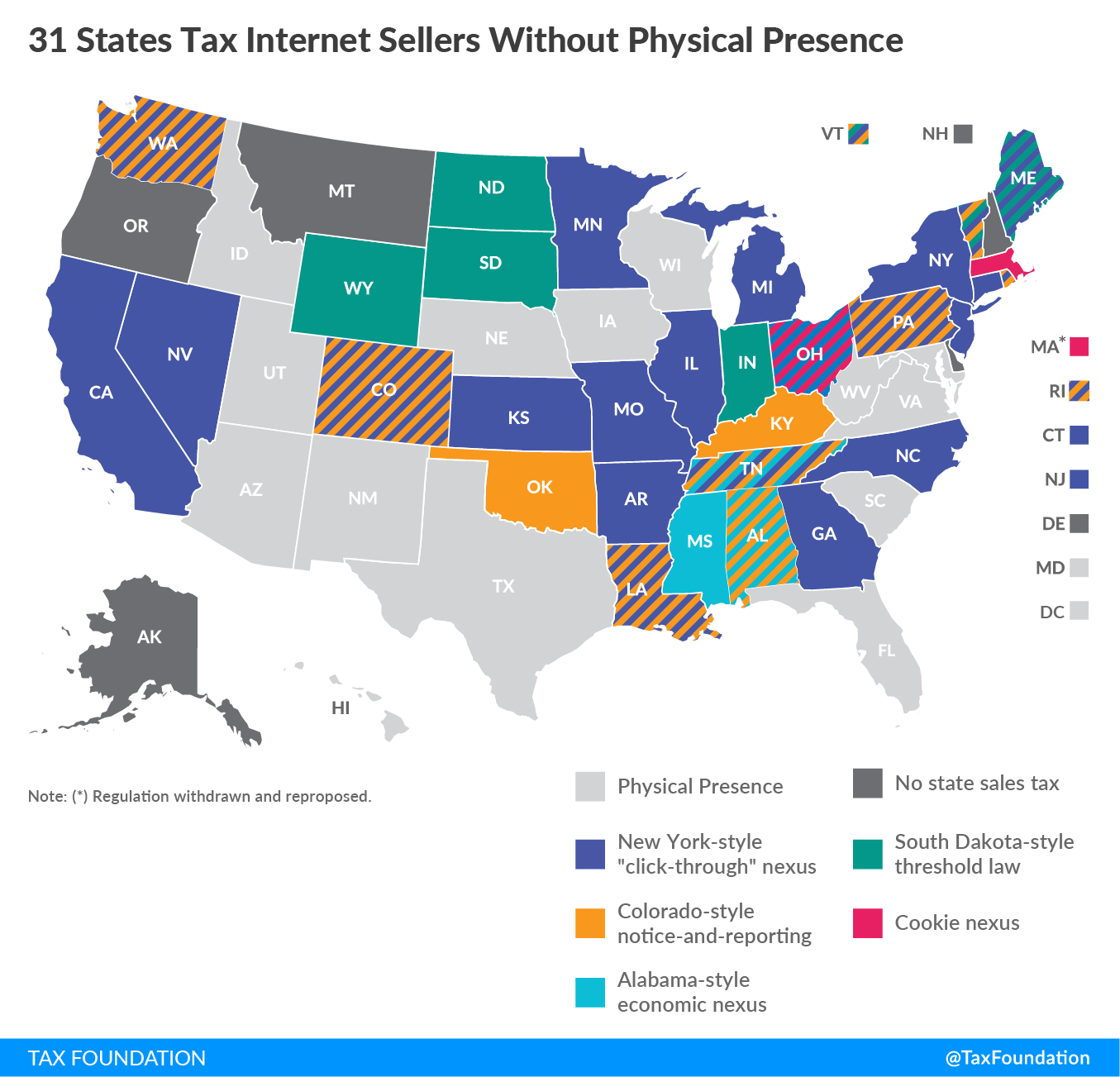

Cost of the Item Sales Tax Rate Total Sales Tax. The South Dakota law makes smaller online sellers exempt from collecting sales tax if they have less than 100000 in annual sales or fewer than 200 transactions. If you do not have a physical presence you generally do not have to collect sales tax for online sales.

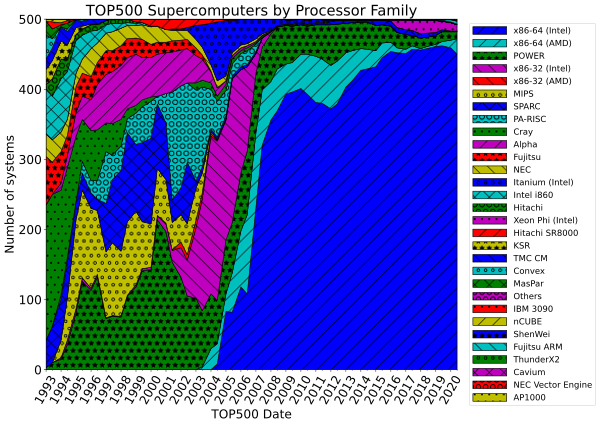

Case that for the first time states and local governments could require online retailers to collect sales tax even if they dont have a physical presence or nexus in the state or local tax jurisdiction. Need guidance on Internet sales tax. First identify the sales tax rate for each state where you are required to pay taxes.

The basic rule for online sellers when collecting sales tax is. The product is taxable in that state. The good news is that with no physical location in Idaho remote sellers are only liable for the 6 state tax no local taxes.

But this can get tricky for online sellers especially sellers with sales tax nexus in multiple states. Your business has sales tax nexus in the same state as your customer. Under the pending bills only businesses that make at least 100000 a year in online sales to Missouri residents would have to collect sales taxes.

At a minimum retailers will be required to collect tax in their home state which. According to Forbes Republicans were worried they could be viewed as increasing taxes. For example say you live in Philadelphia where sales are subject to a 6 state tax plus a 2 county tax.

Effective July 1 2021 Florida law requires businesses making remote sales into the state to collect and electronically remit sales and use tax including any applicable discretionary sales surtax on those transactions if the business has made taxable remote sales in excess of 100000 over the previous calendar year. When doing this step dont forget to transform the percentage into a decimal so that 8 becomes08. Thats 200 for the sunglasses and 19 in sales tax at the 95 rate.

Online sellers who are based in states with destination-based sales tax sourcing are required to charge the sales tax rate at the buyers ship to address. For many years states argued that they were losing money by not collecting sales tax on Internet sales. He said Amazon had a tax to turnover ratio the amount of tax as a proportion of revenue of just 037 compared with about 23 for traditional bricks-and-mortar retailers.

The basic rule for collecting sales tax from online sales is. Britains biggest supermarket said a tax of 2 on. The requirement would take effect in 2023.

The frequency of filing depends on the average monthly tax liability and ranges from annually to monthly. Then multiply that rate by the selling price. Tescos chief executive Dave Lewis has called for an Amazon tax on online sales to prevent more high street shops from going to the wall.

For example if someone bought a 200 pair of sunglasses in your boutique youd charge them 219. If your business has a physical presence or nexus in a state you must collect applicable sales taxes from online. Youd charge 95 sales tax to a buyer.

Supreme Court changed the rules for collecting sales tax by Internet-based retailers stating that individual states can require online sellers to. That case overturned the previous Supreme Court precedent that was established in the 1992 case Quill Corp. You go online and buy 10000 of furniture from an online.

As a seller you are required to calculate and charge the state county city and other local sales tax rates where your buyer is. Effective next year sellers on certain online platforms like Etsy and eBay will receive a 1099-K if their sales are at least 600 down from the current threshold of 20000 with a minimum of 200. Other states will have different thresholds and state laws are changing as.

In June 2018 the US Supreme Court ruled that state and local governments had the right to collect sales taxes from purchases made online no matter where the seller was located. Additionally services are not taxed in Idaho only physical products.

.jpg)